Cybersecurity Insurance

Cyber Insurance Coverage is not Cybersecurity

When busying cyber insurance, you will be asked to prove you have comprehensive cybersecurity in place that reduces risk for your company. Many insurance companies and brokers will ask you to fill out a very detailed form and attest to the truthfulness. You may still get coverage without proof at a much higher rate, or with many exceptions and if there is a cybersecurity event that is claimed, proof of cybersecurity preparedness will be required to process your claim.

Let Cytellix® help you

Background

Executives involved in making cyber security insurance decisions should view the insurance as financial reaction and it will not prevent a break in company operations, performance of its services or losses of clients due to a cyber event. Cyber Insurance along with a structured cyber program that is rooted in a cyber compliance framework is the best mitigation action any company could take to prevent, respond and recover from a cyber event.

In advance of purchasing cyber insurance, a complete cyber framework based assessment would validate and verify the actual cyber posture of the company. It is a best practice to engage a 3rd party expert in this assessment as a confidential evaluation of risk.

A high scoring company in risk and cyber management may be able to negotiate lower premiums and higher coverage levels. Scoring leveraging a standards based cyber framework provides and industry measurement that provides a higher quality of measurement.

There are

Challenge & Exclusions

There is often a disconnect in the expectations for what is covered by most cyber insurance policies. The list below is a general list of topics that may be excluded from some policies and often times may include all of these.Act

- Government Claims

- Acts of War

- Contractual Liabilities

- Criminal Activity

- Disregard for Computer Security

- Extortion/Blackmail

- IP Theft

- Loss of Internet Operations

- Malware forwarding Claims

- Government Claims

Solution

Cytellix® has developed the only solution in the industry that can assess, identify and detect "known" and “unknown” threats in any enterprise environment, while providing complete network visibility.

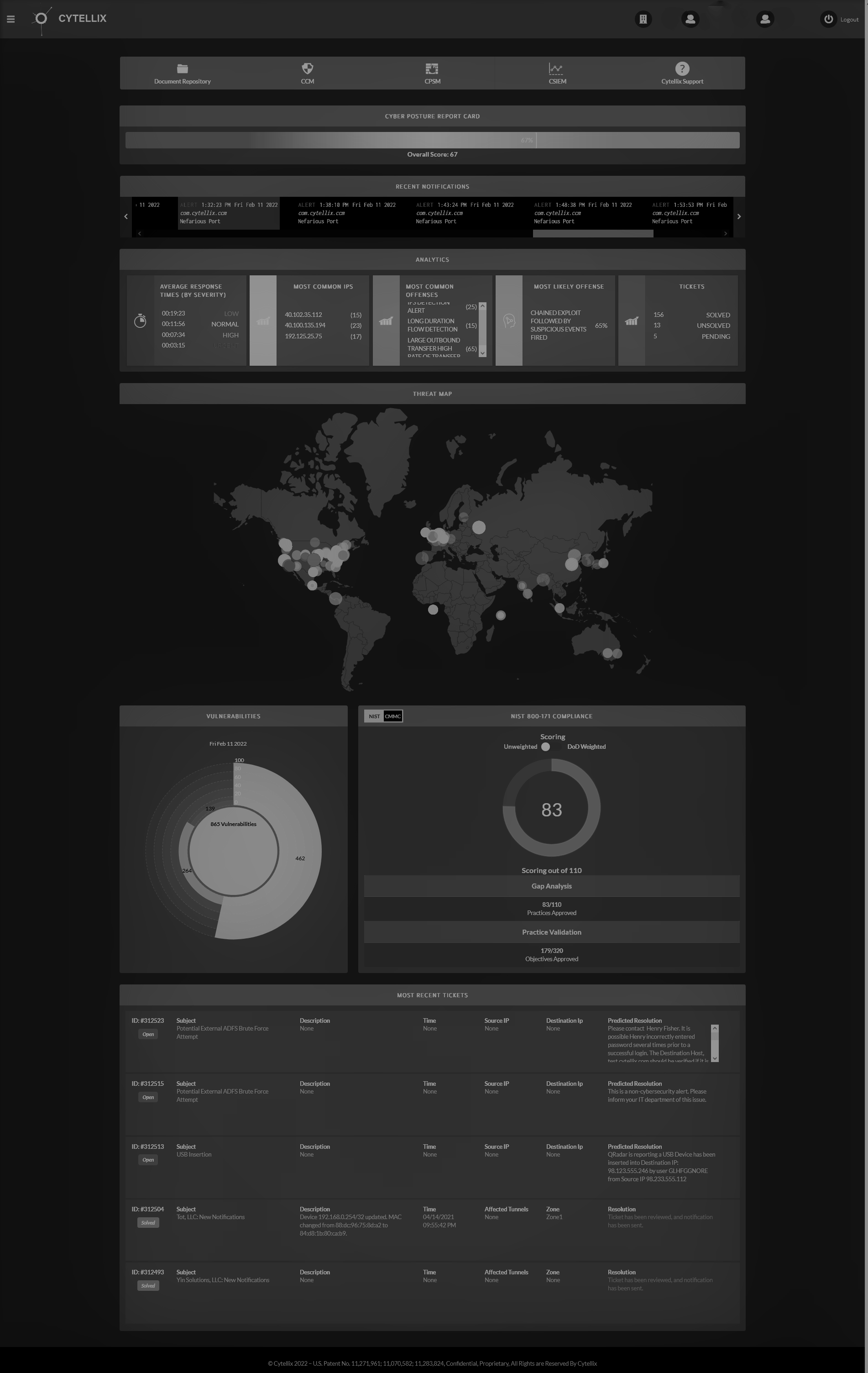

Our patented Cytellix® Cyber Watch Portal (C-CWP™) brings together highly automated Governance Risk & Compliance (C-GRC™) with Managed Detection & Response (C-MDR™) to deliver a complete risk and response system that is targeted to small and medium businesses (SMB's) as an affordable turnkey solution.

Cytellix® can support a company of any size, from a handful of people in a small business to thousands of employees as we have done with the United States Government. Cytellix® uses the best techniques and technologies available today and continues to invent solutions that reduce risk, increase awareness and save our customer money, every day, without question.

Advantages

By combining proactive risk management, reporting, threat discovery and response as a service, Cytellix® safeguards the entire organization — and its web of connected devices, cloud environments, work from home employees and on premise solution — while maintaining compliance with a range of regulatory requirements, including NIST, ISO, SEC, PCI, HIPAA, FERPA and others.

Other key advantages include:

- Start with a turnkey Governance Risk and Compliance (C-GRC™) Solution

- Enhance your Cyber Awareness and Capabilities

- Improve your Cyber Resilience

- Measure your Progress with the C-CWP™

- Report in real-time risks and strengths

- Save money